The Employee Retention Credit (ERC) was intended to help ease the burden on businesses during the Covid-19 Pandemic. The credit allows employers to claim a refund on qualified wages paid to their employees. Unfortunately, scammers have used this credit as an opportunity to convince employers that they qualify for the credit, when in reality, they do not. This leads to substantial IRS penalties, interest and a splitting headache for the employers deceived by aggressive scam promotions. These promotions can come in the form of ads on the radio, TV, and social media. Employers may even receive ads that appear to be official government letters, texts, emails, and/or phone calls that advise them to apply for the credit on their federal employment tax return.

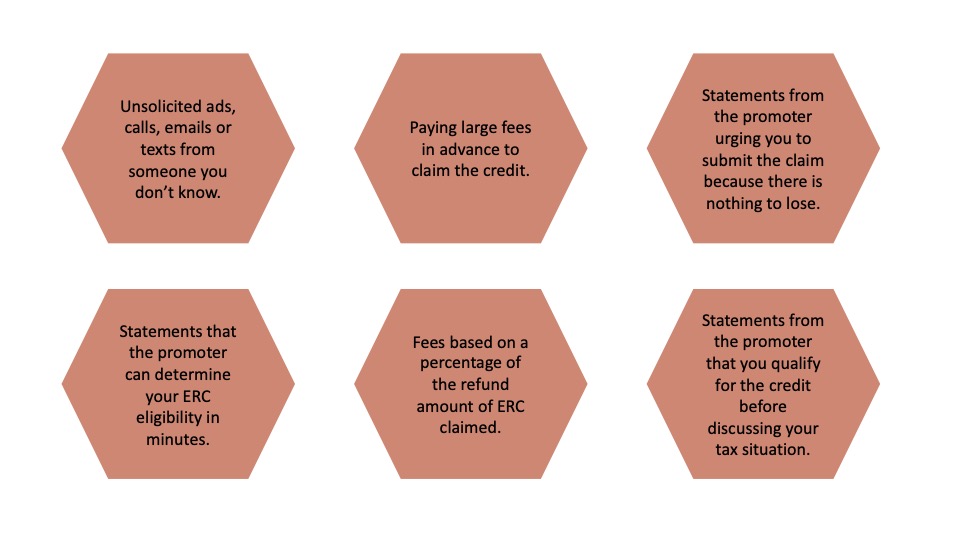

To avoid getting caught up in misleading ERC marketing, employers should be wary of:

Eligibility requirements differ depending on the time period for which you claim the credit, so these promoters may lie about the requirements to convince employers that they qualify for the credit. In addition, those using these companies risk someone using the credit as a ploy to steal their identity or take a cut of their improperly claimed credit. In order to avoid being a victim of fraud relating to the Employee Retention Credit, it’s best to consult us if contacted about applying for the credit.