In a recent survey, 70% of current workers stated they plan to work for pay after retiring. That possibility raises an interesting question: how will working affect Social Security benefits? The answer to that question requires an understanding of three key concepts: full retirement age, the earnings test, and taxable benefits. FULL RETIREMENT AGE Most […]

A Roadmap From Good To Great

If you’ve ever said, “We need better employees,” you’re in good company – which really means you’re in bad company. Most employers are suffering through an epidemic of employee mediocrity. And yet some companies have no problem attracting great talent. Why is that? Like cream rising to the top, great employees often find a path […]

Why I am in a band?

Clearly, it is unusual for a 66-year-old CPA to play drums in a bar band. Along with my friend and bass player, Jeff Strout, I have held down the rhythm section for the Bourbon Brothers band for eight years. Although disclosing this fact is a great icebreaker at parties, and even when meeting new clients, […]

Client Success Story

Rick and Lilah Reichley, owners of Rallar Enterprises, Inc., exemplify entrepreneurs hard work and dedication. They are owners of four Hallmark Gold Crown stores serving the greater Cincinnati / Dayton area, for over 20 years. With locations in Liberty Township, Fairfield, Centerville and Beavercreek, Reichley’s Hallmarks are conveniently located to serve you for any of […]

Cash is King! The Rolling 13-Week Cash Flow Forecast.

Profits are great, but cash is king! You may have heard this colloquial phrase used when analyzing businesses. It refers to the importance of cash flow in the overall fiscal health of a business. Many owners ask how it is possible that my revenues are up, my margins are up, and operating expenses are in […]

Burke & Schindler, PLL merges with Richmond, Indiana CPA Firm

Cincinnati July 1, 2022 – Burke & Schindler, PLL a Cincinnati-based regional CPA firm, founded in 1984 and provider of tax, accounting, business advisory, HR and Staffing, and Wealth Management services, has merged with the Richmond, Indiana CPA firm of Gillam & Zetzl. Gillam & Zetzl (“G&Z”) was formed in 2001 as a result of […]

New Year, New Limits

In October, the IRS issued the maximum benefit and contribution limits for 2022. The good news is that most of the dollar limits increased! 2022 2021 Elective Deferrals – 401(k) and 403(b) Plans $20,500 $19,500 Catch-Up Contributions (over age 50) $6,500 $6,500 Annual Contribution Limit – Defined Contribution Plans $61,000 $58,000 Annual Covered Compensation Limit […]

The Benefits of Digitizing Your Accounts Receivable Process

How does your current Accounts Receivable Process work? How much time is spent printing and mailing invoices to each customer? How about cash application? Are you receiving customer checks in the mail, manually logging them, and then manually applying each to the customer’s account? These processes are time-consuming, labor-intensive, and error-prone. A significant portion of […]

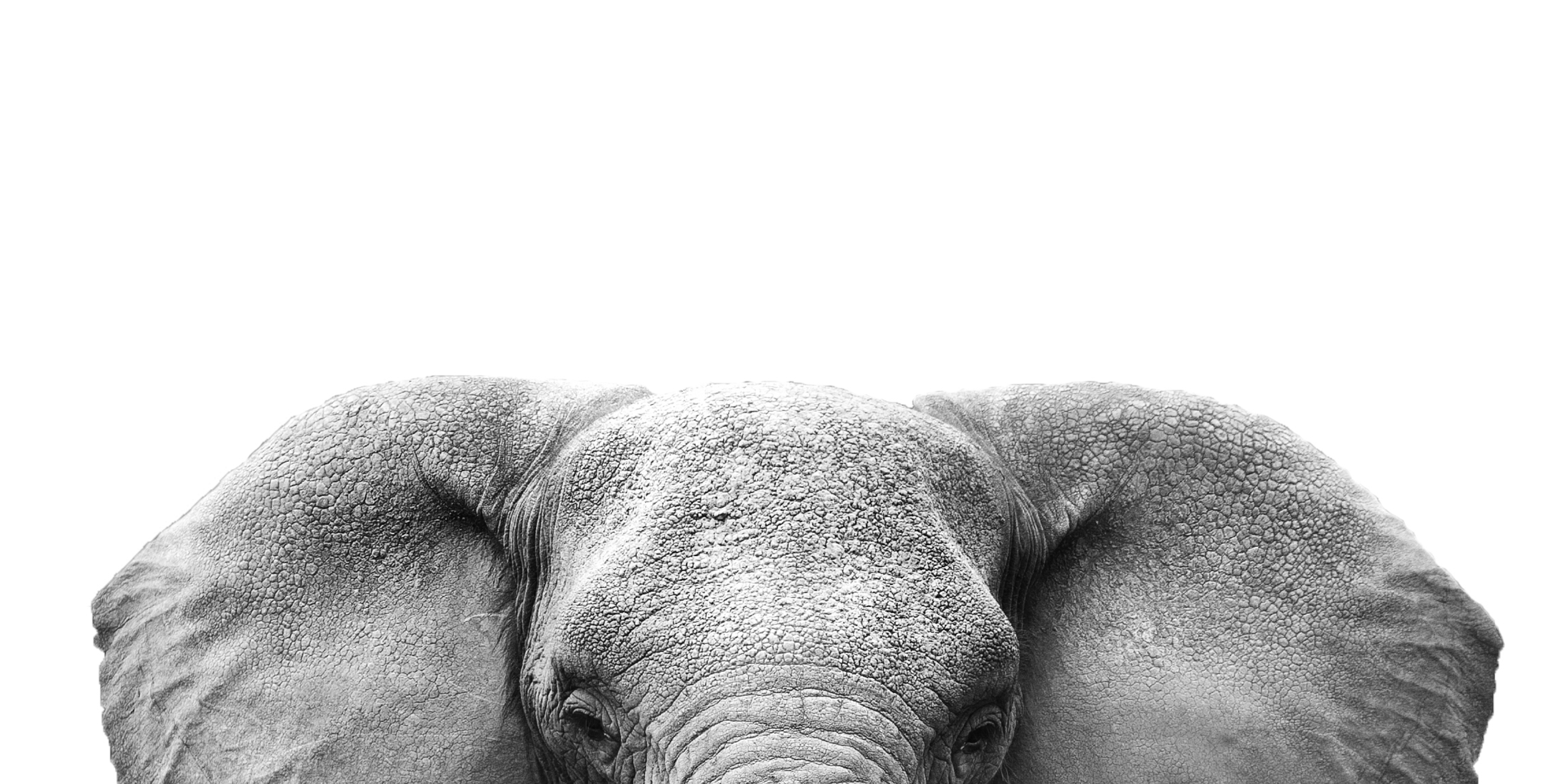

Social Security: The Elephant in the Room

For most Americans, Social Security has represented nothing more than some unavoidable payroll deduction with the positively cryptic initials of “FICA” and “OASDI” (Federal Insurance Contributions Act and Old Age, Survivors and Disability Insurance). It hinted at a future that seemed both intangible and far away. Yet, many Americans now sit on the cusp of […]

So, You Qualified for the ERC (employee retention credit) Credit, Great! You Might Be Wondering: What Should I Expect Now?

We have assisted many of our clients with claiming the Employee Retention Credit (“ERC”). The ERC is a government stimulus program designed to help small businesses that were able to retain their employees during the Covid-19 pandemic. Qualifying businesses that experienced the requisite drop in gross receipts are able to claim a refund on qualified […]